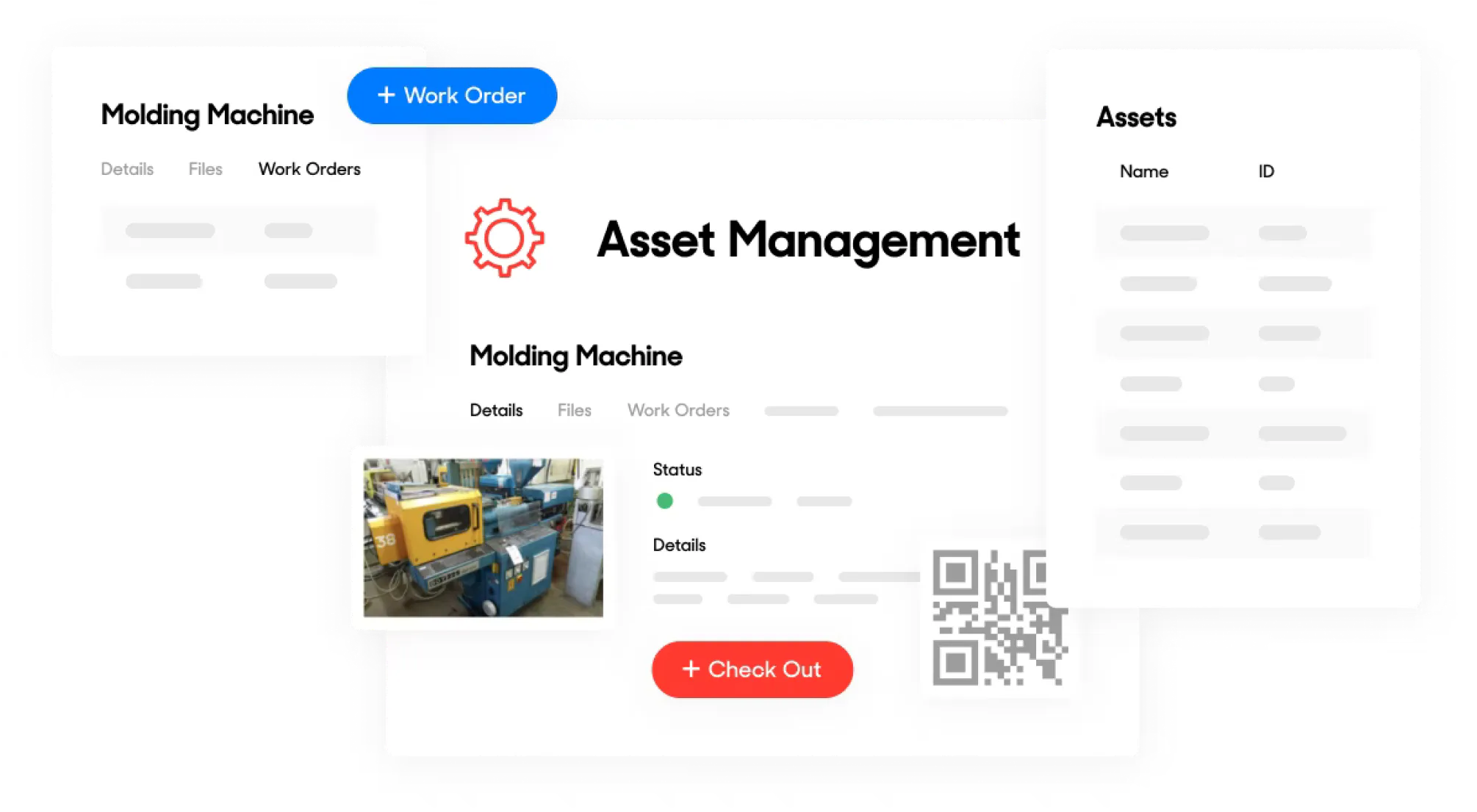

Depreciation Tracking

Asset depreciation tracking made simple

Know the value of assets you perform maintenance on. View depreciation of equipment and machinery without leaving your CMMS.

Track asset depreciation instantly.

Track asset depreciation over time

Visualize an asset depreciation schedule

Achieve the most out of your equipment

Beautiful data visualizations

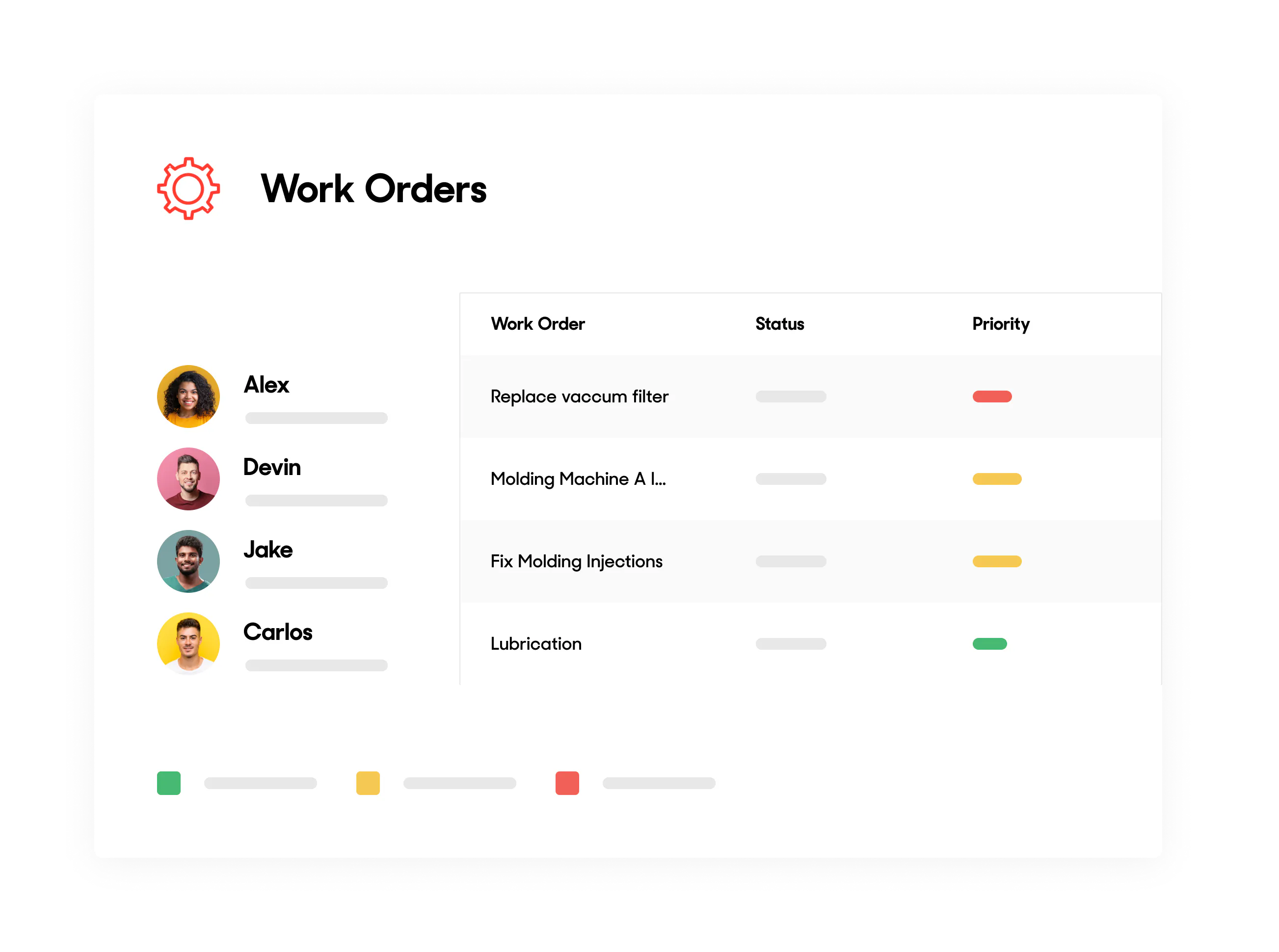

AWARD-WINNING WORK ORDER SOFTWARE

Consistently rated best-in-class.

UPKEEP EXPERTS HERE TO HELP YOU

Incomparable Training, Implementation, and Support Ensures Your Success

We promise expedient account setup, secure data migration, professional online team training, and 24/7 customer support with our maintenance software for churches and non-profits. The Upkeep Customer Success Team works like an extension of your team, helping churches and non-profits hit their maintenance goals by providing useful resources, reliable support, and a personalized plan to help you grow with UpKeep.

Mobile Features

Streamline Your Work Request With a Mobile Maintenance Solution

Never waste time looking for a work request. Unlimited free requesters can submit work requests and track the status of their requests.

Technicians can easily track all time spent on tasks using a timer. Reliable data collected directly from technicians' smartphones helps church and non-profit maintenance managers plan realistic PM schedules.

Reduce interruptions and accomplish more work. Replace radio chatter and phone calls with comments and updates on the status of work orders.

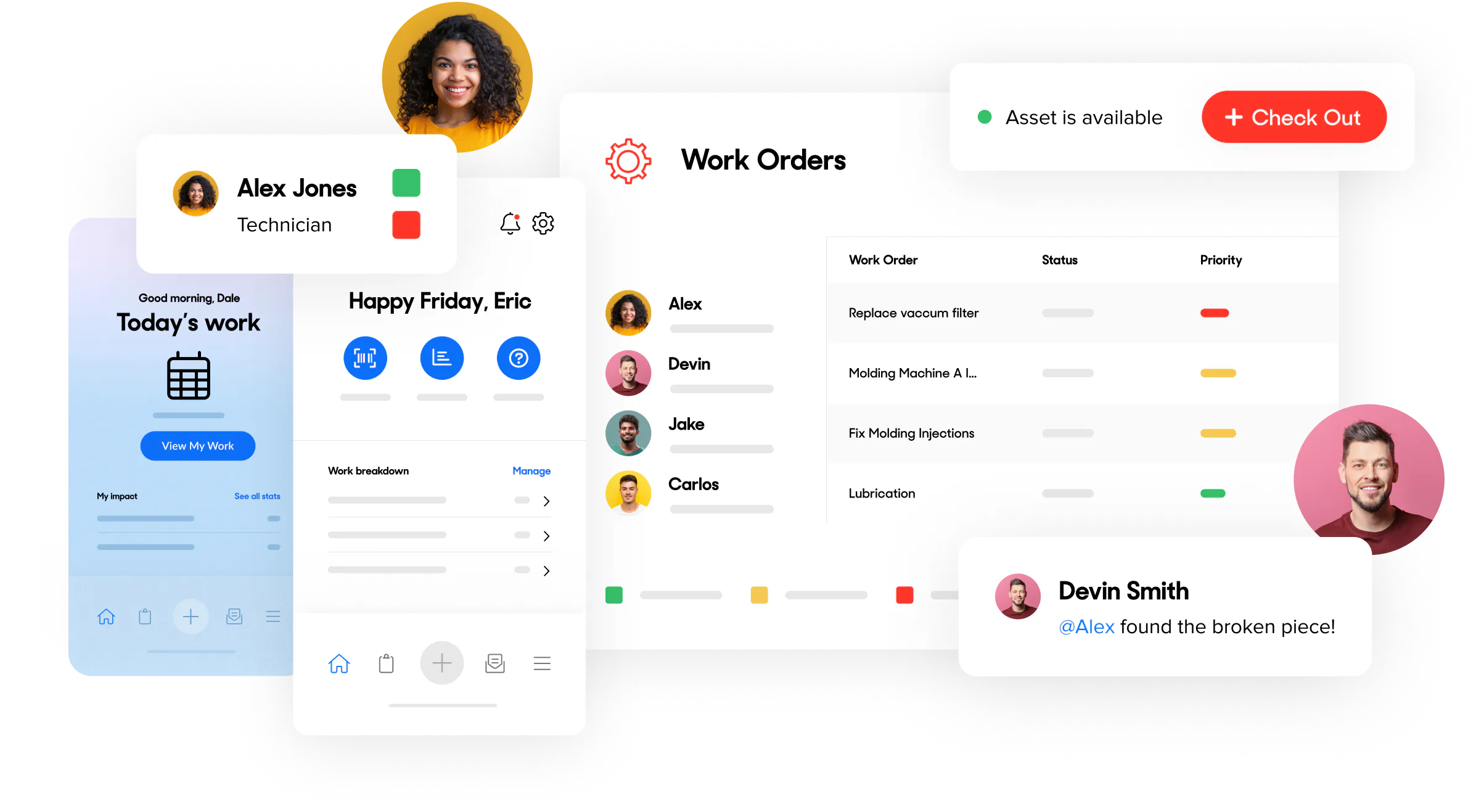

Maintenance Software

CMMS, Maintenance Management, and Work Order Software

UpKeep’s maintenance software for churches and non-profits is consistently rated best-in-class for value for money, ease of use, functionality, and customer support. There’s a reason UpKeep has more 5-star reviews than any other CMMS and Maintenance Software vendor.

Reduce your equipment and asset downtime by up to 26%

Extend your asset and equipment lifetime by up to 11%

Achieve up to 652% ROI by integrating UpKeep into your workflow

Improve overall facility condition with the integration of UpKeep

UpKeep experts here to help you

From expedient account set up, secure data migration and professional online team training to 24/7 customer support, we’ve got you covered. The Upkeep Customer Success Team works like an extension of your team, helping customers hit their maintenance goals by providing useful resources, reliable support, and a personalized plan to help you grow with UpKeep.

Here’s what our customers say about us…

Free Personalized Product Tour